After a burst pipe, the biggest mistake is acting like a victim; you must become the manager of a forensic investigation to secure your compensation.

- Your insurer’s goal is to minimize their payout by finding evidence of your negligence.

- Your goal is to build an undeniable chain of evidence proving you were diligent, from the first phone call to the final repair.

Recommendation: Do not start any permanent repairs before getting written approval. Your first calls are to an independent plumber to stop the leak and document the cause, then to your insurer’s 24/7 line to open a claim.

The silence of a winter night, broken by the unmistakable sound of dripping, then rushing water. It’s the moment every Quebec homeowner dreads. A pipe has burst inside a wall, and chaos ensues. The immediate shock gives way to a frantic effort to save your belongings, but the real battle has just begun. In this state of devastation, the common advice is to call your insurance company and take a few photos. This is the standard playbook, a series of seemingly logical steps to navigate the crisis.

But what if this playbook is designed to serve the insurer, not you? What if every question they ask and every “preferred vendor” they recommend is part of a strategy to limit their liability? The devastating truth is that after a major water damage incident, you are not just a policyholder in need of help. In the eyes of your insurer, you are a potential liability. From this moment on, you are not just a victim cleaning up a mess; you are the manager of a forensic investigation and a high-stakes financial negotiation. Your every move must be a strategic act of evidence collection.

This is not a guide about simply cleaning up water. This is a strategic roadmap for Quebec homeowners, designed by experts in insurance claims. We will dismantle the process piece by piece, revealing the insurer’s perspective at each stage. You will learn not just what to do, but *why* you are doing it, transforming you from a passive recipient of whatever the insurer decides to offer into a proactive force, armed with evidence and ready to claim what you are rightfully owed for the reconstruction of your home and your life.

To navigate this complex process, it is essential to understand each critical step. The following sections break down the journey, from the immediate aftermath to long-term planning, providing you with the expert knowledge needed to protect your interests.

Summary: A homeowner’s strategic guide to managing a burst pipe insurance claim in Quebec

- Post-flood drying: why opening walls is non-negotiable to prevent mould

- Incident report: how to prove freezing was not due to your negligence

- Swollen hardwood floor: can it be saved or must it all be torn out?

- $1,000 or $5,000 deductible: when is it worth claiming for a broken pipe?

- Post-disaster renovation: the opportunity to switch to PEX and never go through this again

- Calling the plumber or the insurer first: the order that changes everything

- The renovation mistake that voids your home insurance in case of water damage

- How to Budget for Plumbing Replacements Over the Next 10 Years?

Post-flood drying: why opening walls is non-negotiable to prevent mould

The visible water is just the tip of the iceberg. The real enemy is the moisture you can’t see, trapped within your walls, insulation, and subfloors. Insurers are acutely aware that mould can begin to grow within 24 to 48 hours. A failure to act decisively is often framed as homeowner negligence, creating grounds to deny a much larger mould remediation claim down the line. According to Square One Insurance, the financial stakes are enormous, as burst pipe incidents cost on average $16,000 in Canada. A significant portion of this cost is tied to secondary damage like mould, which is why professional mitigation is not a suggestion; it’s a requirement to protect your claim.

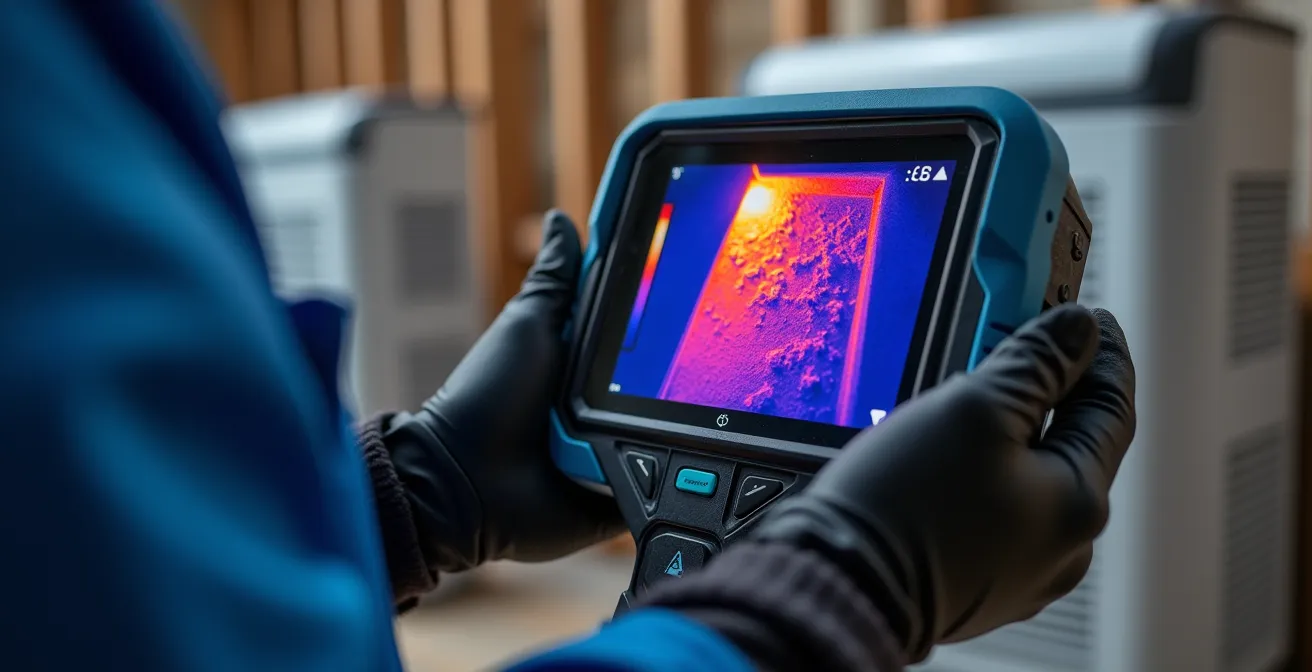

This is why restoration professionals insist on opening up walls. It’s not about causing more destruction; it’s about creating an evidence chain of due diligence. They use specialized equipment to prove the necessity of these actions. To understand what’s happening behind your drywall, technicians rely on technology that makes the invisible visible.

As the image demonstrates, an IICRC-certified technician uses a thermal imaging camera to detect temperature differences caused by moisture. The cool blue and purple patterns on the screen pinpoint exactly where water has saturated the insulation and wooden studs. This visual data is non-negotiable proof for your insurer that invasive drying techniques were not just recommended, but essential. Refusing to allow this step is like handing your insurer a reason to reject future claims related to rot or mould. Your policy requires you to mitigate damages, and in the case of water intrusion, that means exposing and drying every saturated material.

Action plan: 24-48 hour mould prevention protocol

- Document all visible water damage immediately with extensive photos and videos before anything is moved.

- Ensure the main water supply is shut off and contact a professional drying company within the first 24 hours to prevent mould colonization.

- Hire an IICRC-certified restoration company to deploy industrial-grade dehumidifiers and use thermal imaging to map all affected areas.

- Authorize the opening of walls to expose and remove wet insulation, understanding that materials like drywall, plaster, and different insulations require specific removal methods.

- Insist on continuous moisture level monitoring with documented readings until all materials return to acceptable, pre-damage thresholds before any reconstruction begins.

Incident report: how to prove freezing was not due to your negligence

When a pipe bursts due to freezing, your insurer’s first unstated question is: “Was it your fault?” They will immediately investigate for homeowner negligence, the most common reason for denying a frozen pipe claim. The “negligence trap” includes scenarios like leaving the home unheated during a cold snap, failing to have someone check on the property during a vacation, or setting the thermostat too low. Your job is to proactively build a case that proves you were a prudent and diligent homeowner. You must provide irrefutable evidence that you took reasonable steps to heat your home.

In the past, this was a difficult “he said, she said” situation. Today, technology is your best witness. As one case study highlights, data from smart thermostats is a game-changer.

Case Study: Smart Thermostat Data as Irrefutable Proof

Insurance companies investigate whether homeowners maintained adequate heating. Smart thermostats from brands like Ecobee or Nest create a timestamped digital trail of indoor temperatures. This data proves that your heating system was active and set to a reasonable temperature (e.g., above 18°C) throughout a cold snap. When this thermostat data is combined with Hydro-Québec consumption records showing consistent energy usage, it becomes powerful, undeniable evidence against a negligence claim. This digital evidence chain demonstrates proactive heating maintenance, shifting the burden of proof back onto the insurer.

The insurer’s policy documents are very clear on this matter. As experts from BrokerLink Insurance state, your responsibilities are explicit, especially when you are away from the property for an extended period.

If you plan to go away, turn off your water and drain the system or arrange for a regular inspection. Consequently, if you leave your home unattended for an extended period, your homeowners insurance may not cover any water damage due to burst pipes.

– BrokerLink Insurance, Does Insurance Cover Burst Pipes Guide

This underscores the importance of documentation. If you had a neighbour checking in, get a signed letter from them. If you were home, your smart thermostat and hydro bills are your primary evidence. You are not just telling them you were responsible; you are proving it with data.

Swollen hardwood floor: can it be saved or must it all be torn out?

The sight of a once-beautiful hardwood floor now warped and cupping is heartbreaking. The critical question becomes: salvage or replace? The answer is a complex calculation involving time, material, cost, and insurance policy rules. It’s a decision where your desire to save your floor can clash with the long-term realities of water damage and the strict criteria of your insurer. Acting too slowly or making the wrong choice can lead to future problems like mould growth under the floorboards and a denied claim.

Several factors determine the fate of your floor. The species of wood is critical; hard, dense woods like Canadian maple (érable) or yellow birch have a better chance of being saved if addressed quickly. Softer woods or, critically, engineered flooring, often delaminate and are almost always a total loss. The duration of water exposure is paramount; after 72 hours, the chances of successful salvage drop dramatically. Your insurer will also apply the “line of sight” rule: if a matching material isn’t available to seamlessly patch a partial replacement, they may be obligated to replace the entire continuous floor area.

To help make this decision, restoration experts and public adjusters often use a matrix that weighs the key variables. This clarifies whether the significant cost of full replacement, which YouSet reports can be part of claims in Quebec typically ranging from $9,000 to $12,000, is truly necessary.

| Factor | Salvageable Indicators | Replacement Required |

|---|---|---|

| Water Exposure Time | Less than 48 hours | More than 72 hours |

| Wood Species | Hard maple (érable), yellow birch | Softer woods, engineered floors |

| Insurance Criteria | Matching materials available | Line of sight rule violation |

| Building Type | Heritage Montreal plex (value retention) | 1990s suburban (cost-effective replacement) |

| Typical Cost Range | $3-5 per sq ft (refinishing) | $8-15 per sq ft (full replacement) |

Ultimately, while saving the floor may seem ideal, a full replacement paid for by insurance often provides better long-term value and peace of mind, eliminating the risk of hidden moisture and future warping. Document the floor’s condition extensively and let the professional assessment guide your negotiations with the adjuster.

$1,000 or $5,000 deductible: when is it worth claiming for a broken pipe?

After a pipe bursts, the immediate instinct is to file a claim. However, this is not always the most financially sound decision. Filing a claim, especially for a smaller amount, can have long-term consequences that cost you far more than paying for the repairs out-of-pocket. This is the Claim vs. Premium Calculus, a strategic assessment that every homeowner must make. With Square One Insurance reporting a staggering 191% increase in frozen pipe claims in a recent year, insurers are more sensitive than ever to water damage risk, and they will adjust your premiums accordingly after a claim.

The core of the calculation is simple: will the total cost of your increased premiums over the next 3-5 years, plus your deductible, be more than the cost of the repair? If the damage is estimated at $4,000 and your deductible is $1,000, the insurer’s payout is $3,000. But filing that claim will likely cause you to lose your ‘claims-free’ discount and see a significant premium surcharge for several years. That “free” $3,000 could end up costing you $4,500 in extra premiums over time.

As this scene of a concerned homeowner suggests, this is a decision that requires careful analysis of your policy and repair estimates. Major Quebec insurers like Desjardins, Intact, and La Capitale all have internal risk models that penalize water damage claims heavily. As a general rule of thumb, many experts suggest that if the total repair cost is less than $5,000, it is often wiser to pay out-of-pocket to protect your insurance record and long-term affordability. For condo owners, the calculus is even more complex, as an individual claim can trigger a premium increase for the entire building’s syndicate insurance, creating pressure to handle smaller incidents privately.

Case Study: Long-term Premium Impact Analysis

An analysis of policies from major Quebec insurers shows that filing a single water damage claim typically results in significant premium increases that last for 3 to 5 years. The loss of a ‘claims-free’ discount alone can represent 10-20% of the premium. A homeowner with a $1,500 annual premium might lose a $200 discount and receive a $300 surcharge, costing them $500 extra per year. Over three years, that’s $1,500. Add the initial $1,000 deductible, and the real cost of that claim is $2,500. This is why, according to a report by experts at Rates.ca, paying for damages under $5,000 yourself is often the more prudent financial strategy.

Post-disaster renovation: the opportunity to switch to PEX and never go through this again

When your walls are open and your plumbing is exposed, it feels like the lowest point of the disaster. However, it is also a unique strategic opportunity. Your insurance policy obligates the insurer to pay for the replacement of damaged components to their pre-loss condition—what they call “like, kind, and quality.” If you had copper pipes, they will pay for new copper pipes. But this is your chance to execute a “betterment proposal” and upgrade to a more resilient material like PEX (cross-linked polyethylene) tubing, which is far more resistant to bursting in freezing temperatures.

The key is in the negotiation. The insurer is not obligated to pay for the upgrade itself. However, they are obligated to pay the full cost of the standard replacement. Your strategy is to get a quote for the copper replacement (the amount the insurer will cover) and a separate quote for a full PEX installation from a CMMTQ-licensed plumber. You then present this to your adjuster and propose to pay only the difference in cost out of your own pocket. Often, this difference is surprisingly small compared to the immense peace of mind and future-proofing it provides.

This is a proactive step that transforms a reactive repair into a long-term investment in your home’s resilience. It demonstrates to future insurers that you have taken concrete steps to mitigate risk, which can positively impact your premiums down the road. It’s crucial to follow a clear process to ensure your insurer approves and your upgrade is documented correctly.

- Step 1: Get your insurer’s written approval for the cost of the standard copper-to-copper replacement. This is your baseline coverage amount.

- Step 2: Obtain detailed quotes from CMMTQ-licensed plumbers for both the standard copper repair and a full PEX system installation.

- Step 3: Formally present your betterment proposal to the adjuster, clearly stating you will pay the price difference for the PEX upgrade.

- Step 4: Before signing any contract, verify your chosen plumber’s RBQ license on the official government website to ensure the work is compliant.

- Step 5: Keep all receipts and document the upgrade as a permanent property improvement for future insurance assessments and potential resale value.

Calling the plumber or the insurer first: the order that changes everything

In the panic of a burst pipe, the most critical decision you’ll make in the first 30 minutes is who to call first. The common platitude is “call your insurer,” but this is a strategic error. Your absolute first priority is mitigation—stopping the flow of water and preventing further damage. Your insurance policy requires you to do this. Therefore, your first call must be to an emergency plumber. Your second call, once the immediate leak is stabilized, is to your insurer’s 24/7 claims line.

This order is crucial for two reasons. First, it demonstrates you are a “prudent and diligent” policyholder focused on minimizing the loss, which strengthens your position. Second, and more strategically, it allows you to get an independent diagnosis of the cause of the failure. As David Forte from Washington State’s Insurance Commissioner office emphasizes in a protocol that mirrors expectations in Quebec, “As soon as the water is stopped and it’s stabilized, call the insurance company. Don’t begin any repairs yet until you’ve notified the insurance company.” This separates the emergency stop from the full repair, which requires insurer approval.

When you call the plumber, your instructions must be precise. You should say: “I have an active water leak from a burst pipe and I need an emergency stop. I also need a written report on the cause of the failure for my insurance company.” This ensures the plumber’s invoice and report become the first piece of your evidence chain, documenting the cause from an unbiased, licensed professional. Using an insurer’s “preferred plumber” for this initial diagnosis can be risky, as they have a vested interest in maintaining a good relationship with the insurance company, which may influence their report. You can always use the insurer’s network for the larger, approved restoration work later, but the first diagnosis should be yours.

The renovation mistake that voids your home insurance in case of water damage

One of the most painful scenarios for a homeowner is to have a legitimate water damage claim denied because of past mistakes. A common and devastating error in Quebec is undertaking plumbing work, even seemingly minor renovations, with unlicensed individuals. If a pipe bursts and the source of the leak is traced back to a fitting, valve, or connection installed by someone without a valid RBQ (Régie du bâtiment du Québec) or CMMTQ (Corporation des maîtres mécaniciens en tuyauterie du Québec) license, your insurer has strong grounds to void your coverage entirely.

The logic is unassailable from the insurer’s perspective. Your policy contains a “due diligence” clause, requiring you to maintain your home according to provincial laws and building codes. Hiring an unlicensed plumber is a direct violation of this. As experts at Western Financial Group note, this gives the insurer a powerful reason for denial.

If the leak originates from a fitting installed by someone without a valid RBQ license, the insurer has strong grounds to deny the claim due to a violation of the building code and the policy’s due diligence clause.

– Western Financial Group, Home Insurance Coverage Guide

This isn’t the only renovation-related pitfall. Insurers look for any “material change in risk” that you failed to declare. Finishing a basement, for instance, adds significant value and water damage risk to your home. If you didn’t inform your insurer of this renovation, they can argue the premium you were paying did not reflect the actual risk they were covering, and deny the claim. To protect yourself, it’s vital to avoid these common but critical errors:

- Using unlicensed plumbers: Always verify CMMTQ or RBQ credentials on their official websites before any work begins. This is non-negotiable.

- Not declaring major renovations: Inform your insurer of any significant changes, especially basement finishing, additions, or major kitchen/bathroom remodels.

- Installing illegal components: The use of non-compliant parts like “cheater vents” (évents automatiques) will immediately void a claim related to their failure.

- Hiring general contractors with unlicensed sub-trades: You are responsible for ensuring the plumber the GC hires is licensed. Ask for proof.

- DIY plumbing without permits: Any plumbing work beyond changing a faucet requires skills and often permits. Uninspected DIY work is a massive red flag for insurers.

Key takeaways

- After a burst pipe, your role shifts from homeowner to lead investigator; your goal is to build an undeniable evidence chain.

- Every action, from the first call to a plumber to opening walls for drying, is a strategic move to counter potential negligence claims from your insurer.

- The financial decision to file a claim must be weighed against long-term premium increases; for damages under $5,000, paying out-of-pocket is often wiser.

Building a Resilient Home: Budgeting for Future Plumbing Peace of Mind

Surviving a burst pipe claim is an ordeal that fundamentally changes your relationship with your home. The reconstruction phase shouldn’t just be about returning to the status quo; it should be about building a more resilient future. The most effective way to manage plumbing disasters is to prevent them. This requires shifting from a reactive mindset to a proactive one, which includes budgeting for systemic plumbing replacements over time, especially in an aging Quebec housing stock.

Just as the City of Montreal’s proactive efforts have led to a 50% reduction in water main breaks through systematic replacement of old iron pipes, you must think of your home’s plumbing as your personal infrastructure. If your home was built before the 1990s, you likely have copper pipes that are nearing the end of their functional lifespan. A post-disaster renovation is the perfect, albeit forced, opportunity to begin a phased replacement with superior materials like PEX.

Creating a 10-year plumbing budget may seem daunting, but it’s a simple risk-management exercise. Start by having a licensed plumber conduct a full inspection to identify the age and condition of your pipes, especially in vulnerable areas like unfinished basements or crawl spaces. They can help you create a priority list. Perhaps you replace the plumbing in the renovated area with PEX this year. In three years, you proactively tackle the kitchen plumbing during a minor remodel. This phased approach spreads the cost and gradually hardens your home against future disasters. The money spent on these proactive upgrades is an investment that pays dividends in lower risk, greater peace of mind, and a more valuable, resilient property.

Your home has been damaged, but your control over its future has not. Armed with this strategic knowledge, your next step is to manage your claim and rebuild not just as you were, but better. Start building your evidence chain and planning for a more resilient home today.

Frequently Asked Questions About Burst Pipe Claims in Quebec

Should I use my insurer’s preferred plumber for initial diagnosis?

No. It is highly recommended to use an independent, CMMTQ-licensed plumber for the crucial first diagnosis. This ensures you receive an unbiased report about the cause of the pipe failure. You can use the insurer’s network for the larger, pre-approved restoration work later, but the initial evidence collection should be controlled by you.

What exactly should I tell the emergency plumber?

Be very specific. Say: “I need an emergency stop of the leak and a detailed, written diagnosis of the cause of failure for my insurance claim.” This frames the job correctly and ensures you get the proper documentation you need from the very start of your evidence chain.

When should I use online claim portals vs calling?

For a sudden and accidental event like a burst pipe, always call the 24/7 emergency claims line first. This time-stamps your initial report and gets the process started immediately. Use the online portals (like a “Sinistre en ligne”) afterwards for uploading the documentation, photos, and reports you have gathered.